The crowdfunding space has been buzzing about Regulation A+, a regulation that allows companies to raise capital from the public. Proponents argue it's a revolutionary tool for small businesses and startups, while critics warn of potential risks. So, is Regulation A+ truly the silver bullet it's often described to be, or just another hype cycle?

- Dissecting the realities of Regulation A+ offerings requires a balanced approach.

- Investors must thoroughly research the potential of any investment opportunity, regardless of the funding method.

- Transparency from companies seeking capital is paramount to making educated decisions.

The path of Regulation A+ remains up in the air, but its impact on the capital markets is undeniable. As with any innovation, time will eventually tell if it lives up to the hype.

Regulation A+ | MOFO

Morrison & Foerster (MOFO) has comprehensive expertise in navigating the complexities of Regulation A+, a federal securities regulation. Our team of seasoned attorneys collaborates closely with companies to design compliant offerings and assist them through the entire process. From initial planning to regulatory filings and communication, MOFO provides tailored solutions crafted to meet specific needs.

- Leveraging its deep understanding of securities law and regulatory framework

- MOFO

- Supports companies in completing Regulation A+ registration statements

Explain Title IV Regulation A+ for me | Manhattan Street Capital

Title IV Regulation A+, also known as Reg A+, is a financial strategy that allows enterprises to raise funds from the public. It provides a avenue for smaller firms to access private capital, without having to go through a traditional initial public offering. Manhattan Street Capital is a marketplace that specializes in processing Reg A+ campaigns for entrepreneurs.

Under Regulation A+, companies can raise up to a maximum of \$75 million in a 12-month period. There are certain guidelines that entities must comply with, such as financial reporting. Manhattan Street Capital can provide assistance to companies throughout the Reg A+ path, helping them to navigate the requirements.

Revolutionize Your Fundraising Efforts with a New Reg A+ Solution

Are you exploring innovative methods to raise capital for your business? Look no further than the cutting-edge new Reg A+ solution, designed to guide companies like yours to their financial objectives.

Leveraging the power of the mainstream markets, this robust solution offers a accessible path to investment. With its flexible structure and streamlined process, the Reg A+ solution is suited to fulfill the individual needs of entrepreneurs of all scales.

- Benefit 1: This could be a benefit like increased capital access

- Benefit 2: This could be another benefit like brand awareness growth

- Benefit 3: This could be a final benefit like enhanced credibility

Discover the impactful potential of the new Reg A+ solution and embark your fundraising journey to the next milestone.

Tell me about Is A Reg - We Have All Of Them

We're talking about the realm of regulations. You see, a regulation is basically a set of instructions that govern how things should be done. Consider it like this: a recipe for life in specific fields.

- Situations of regs are everywhere!

- From your morning coffee to the newest tech gadget, there's a reg watching over it.

They are all about order, you know? And don't worry, we've got the inside scoop about them. Get ready because this is a journey into the unknown of regulations!

Navigating Capital Through Regulation A+ for Your Company

Regulation A+, a relatively recent fundraising strategy, presents a unique opportunity for startups to raise investment. By issuing securities to the public, companies can tap into a wider pool of investors and fuel growth.

Nevertheless, it's essential for startups to thoroughly understand the requirements surrounding Regulation A+ before embarking on this path.

Some key considerations include:

* Compliance: Startups must strictly adhere all federal securities laws and regulations, including filing detailed reports with the Securities and Exchange Commission (SEC).

* Due Diligence: Conducting comprehensive due diligence is critical to mitigate risks and confirm the accuracy of financial reports.

* Understanding Your Audience: Startups should carefully assess their customer base to determine if Regulation A+ is the right funding strategy for their needs.

By consistently addressing these factors, startups can successfully leverage Regulation A+ as a valuable tool to achieve their expansion goals.

Understanding Regulation A+ and Equity Crowdfunding

Regulation A+, a specialized framework within the Securities Act of 1933, offers companies an alternative path to raise capital through equity crowdfunding. This provision allows businesses to offer and sell securities to the public without undergoing a traditional initial public offering (IPO). By leveraging Regulation A+, companies can secure investments from a broader pool of individuals, often through online platforms dedicated to equity crowdfunding.

- Essentially, Regulation A+ establishes limits on the amount of capital a company can raise during an offering and outlines specific disclosure requirements. These requirements ensure that investors have access to comprehensive information about the enterprise and its financial performance.

- One key perk of Regulation A+ is its ability to make accessible investment opportunities for everyday individuals, often referred to as "angel investors" or "retail investors." This allows a wider range of people to participate in the growth of promising businesses.

- Additionally, Regulation A+ can provide companies with significant flexibility compared to traditional IPO processes. The streamlined registration process and reduced regulatory burden make it a more streamlined option for certain startups and growth-stage companies.

Nevertheless, it's important to note that Regulation A+ still requires companies to comply with extensive reporting and disclosure obligations. Investors should conduct their own due diligence and carefully review all available information before making investment decisions.

Regulation Plus FundAthena

FundAthena leverages the advantages of Regulation A+ to offer unique investment opportunities . The framework allows for increased access to capital for growth companies , enabling them to scale . FundAthena's dedicated team thoroughly vets project proposals, ensuring due diligence throughout the cycle. Through its holistic approach, FundAthena strives to connect the gap between stakeholders and impactful ventures.

Special Purpose Acquisition Corporations Regulation of SPAC Investments

The burgeoning realm of blank-check companies has ignited both interest and skepticism within the financial landscape. Policymakers, acutely aware of the possibility for abuse, are actively crafting a regulatory system to monitor these unique investment instruments. {Specifically|, the focus is on preserving investors from deceptive practices and guaranteeing market transparency. This complex task involves a balancing act between fostering progress in the financial sector and reducing systemic risk.

Got Our Hands On A Reg

The team was pumped/ecstatic/overjoyed to finally get their hands on/locate/discover the elusive Reg. Months of searching had led them through/taken them across/sent them over countless landscapes/territories/areas, but now it was right there before them/within their grasp/finally in sight. The Reg, a legendary artifact/machine/device, was said to hold the key/possessed incredible power/had been rumored to unlock secrets that could change the world/rewrite history/alter the course of civilization.

- Initial plans/The immediate goal/Their first order of business was to secure/protect/guard the Reg from falling into the wrong hands/hands of adversaries/enemy's possession.

- Next steps/What came next/Following this discovery would be a delicate operation/process/task requiring expert knowledge/specialized skills/deep understanding to tap into/harness/utilize the Reg's full potential.

Accessing Funding Through Title IV Reg A+ Crowd-funding

Dive deep into the world of Regulation A+, a powerful tool for businesses seeking to raise capital. Our latest infographic breaks down everything you need to know about Title IV Reg A+, including its advantages, process, and how it can help your business succeed.

- Explore the fundraising landscape through a visual guide.

- Gain insight about the key characteristics of Title IV Reg A+.

- Unearth real-world examples of businesses that have employed Reg A+ to achieve their goals.

Don't miss out on this valuable resource. Share it with your network and stay ahead of the curve in the ever-evolving world of funding.

Regulation A+ Securities - Securex Filings LLC

Securex Filings LLC assists comprehensive solutions for businesses looking to to raise capital through a Regulation A+ investment. Our experienced team of professionals assists clients through the full process, beginning to filing with the SEC to closing.

We concentrate in all aspects of Regulation A+ compliance, including legal review, compiling offering documents, and interaction with the SEC. Securex Filings LLC is dedicated to supporting companies successfully navigate the Regulation A+ process to attain their capital raising goals.

Explore Crowdfund.co Quickly

Crowdfund.co is your go-to platform for all things crowdfunding. With a vast library of initiatives, you can explore compelling opportunities to invest in. The intuitive interface makes it effortless to search projects by category. Whether you're passionate about social impact, Crowdfund.co has something for everyone.

- Engage with creators

- Contribute to a cause

- Benefit from rewards

Fundrise Reg A Offering

Fundrise is a leading real estate crowdfunding platform that has announced a Regulation A+ offering to raise capital for its diverse range of investments. This offering allows individual investors the opportunity to acquire shares of Fundrise's real estate holdings. The funds raised will be used to expand Fundrise's portfolio, providing further growth and potential returns for existing investors.

The Reg A+ offering is open to both accredited and non-accredited investors than traditional private placements. This makes it a more inclusive way for people to invest in real estate, regardless of their financial background.

A Securities and Exchange Commission

The Securities and Exchange Commission is/serves as/acts as the primary regulatory/governing/oversight body in/for/of the United States securities/investment/financial markets. It/Its purpose is to/ Established in/Founded in, the SEC has a mission to/seeks to/aims to protect investors, maintain/ensure/promote fair and orderly markets/trading/transactions, and to facilitate/encourage/foster capital formation. This involves/It encompasses/The SEC's responsibilities include registering securities offerings, overseeing/regulating/monitoring broker-dealers and investment advisors/consultants/managers, and investigating/prosecuting/addressing potential violations of securities/financial/investment laws. The SEC also provides/issues/offers investor education/outreach/resources.

Equity Crowdfunding Title IV CrowdExpert Reg A+

Raising capital through online investment portals like CrowdExpert is an increasingly popular option for businesses looking to tap into the vast pool of potential investors. Title IV Reg A+ offers|presents a unique opportunity for enterprises pursuing capital to connect directly with a wider investor base.

Under this framework, companies can secure up to $75 million through the sale of equity securities. This compliance system simplifies the process of|expedites the fundraising journey by providing a clear set of click here rules.

Consequently, Reg A+ offers significant advantages over traditional financing approaches, including lower fees, increased transparency, and wider access to funding.

Testing the Waters

Before diving headfirst into any project, it's wise to gauge the waters first. This entails a strategic approach, where you gently introduce your ideas or actions to see how they are perceived. It's a way to reduce risks and acquire valuable feedback before making a full commitment.

Mass Appeal Fundraising

Crowdfunding has moved beyond its niche beginnings to become a powerful tool for individuals and organizations alike. The ability to gather resources from a large network of backers has democratized access to financing. Projects ranging from small-scale creative endeavors to ambitious social ventures can now find support through the collective wisdom of the masses.

This widespread reach has created a thriving ecosystem where innovation flourishes. As crowdfunding platforms become more sophisticated, its impact on local communities is only expected to intensify.

Crowdfunding has become more than just a way to raise money; it's about creating a sense of collective action around ideas that resonate deeply.

FundingCircle

StreetShares is the premier online lender that focuses on small businesses. With a desire for making funding more accessible capital, StreetShares facilitates loans between entrepreneurs and investors. Their technology-driven platform allows businesses to access capital quickly and easily.

- Its lending approaches are designed to cater to the demands of small business owners.

- Additionally, they provide a range of financial products such as equipment financing.

- The company is passionate about fostering economic growth within local communities.

Harnessing Regulation A+ for Thriving Fundraising

Regulation A+, a provision of the Securities Act of 1933, offers a unique pathway for companies to raise capital from the public. This regulation allows companies to offer and sell securities to both accredited and non-accredited investors through a streamlined process, potentially opening doors to a broader pool of funding. By utilizing Regulation A+, businesses can gain significant investment while maintaining transparency. A well-executed Regulation A+ offering can provide the necessary capital to fuel growth, expand operations, and ultimately achieve success.

- Essential factors for achieving success in a Regulation A+ fundraising campaign include developing a compelling business plan, establishing a strong team of advisors, and clearly communicating the company's mission to potential investors.

- Harnessing the right marketing channels is also crucial for reaching a broad investor base. Companies can harness social media platforms, industry events, and online communities to cultivate excitement and attract investment.

Be aware that a successful Regulation A+ fundraising campaign requires meticulous planning, diligent execution, and ongoing communication with investors. By adhering to regulatory requirements and building strong investor relationships, companies can unlock the immense potential of this funding mechanism and pave the way for sustainable growth.

Equity-Net Reg A+ Offerings Regulation A+

Regulation A+, also recognized as Reg A+, empowers privately held companies to raise capital from the public through a simplified and streamlined process. EquityNet, a prominent online platform facilitating private company funding, actively enables this by connecting companies with prospective investors interested in participating in Reg A+ offerings. These offerings permit companies to attract investments up to $75 million within a defined timeframe, offering an alternative to traditional fundraising methods. By leveraging EquityNet's robust network and user-friendly platform, companies can proceed through the complexities of Reg A+ compliance while engaging a broader pool of investors.

Supervision A+ Companies

The landscape for highly performing companies has become increasingly demanding. With the rise of legal frameworks, securing an "A+" ranking signifies a commitment to superiority practices. These companies often implement cutting-edge processes to ensure transparency. This dedication to governance not only enhances their profile but also strengthens trust with stakeholders.

- {Furthermore|Additionally, A+ companies often engage in proactive threat management strategies to mitigate potential issues.

- These commitment to social responsibility is also a hallmark of this elite group.

Oversight A+ Summary

A robust framework is essential for ensuring stability within any field. This summary provides a thorough analysis of the current climate, highlighting its strengths and limitations . It also explores approaches for strengthening policies to encourage a successful marketplace .

- Main points

- Regulatory trends

- Impact on stakeholders

Governance + Real Estate

The domain of real estate is a dynamic and nuanced one. It's constantly changing in response to market forces. To ensure fairness, robust standards are essential. These frameworks aim to defend both buyers and sellers, encouraging a thriving real estate market.

A primary focus of real estate regulation is to prevent misleading practices. Statutes are in place to regulate aspects like property deals, transparency, and licensing of real estate professionals.

These steps help to build a credible real estate market where buyers can assuredly participate.

Observance with real estate regulations is vital. Failure to do so can consequence in severe penalties, including penalties.

It's therefore essential for all real estate actors, from agents to developers and owners, to have a detailed understanding of the applicable rules. This understanding is critical to conducting business in the real estate field ethically and properly.

Keeping informed about changes in real estate regulation is an ongoing endeavor. Regulatory bodies often modify existing rules or implement new ones to reflect to evolving market circumstances.

Real estate experts must frequently develop their knowledge base to ensure compliance and navigate the complex governmental landscape.

Initial Public Offering First JOBS Act Company Goes Public Via Reg A+ on OTCQX

It's an exciting day for our company as we officially go public through a Regulation A+ offering on the OTCQX marketplace! As one of the first companies to utilize the JOBS Act, this represents a landmark in our journey.

We're incredibly grateful for the support of our investors and team who have helped us get to this moment. This public listing will offer us with the resources to grow our business and bring our goals to life.

We're excited about the future and look forward to celebrating this journey with all of you.

FundersClub Launches Reg A+ Raises on the Platform

FundersClub, a well-established marketplace for seed-funded companies, is excited to announce the ability for its members to conduct Reg A+ raises directly on the platform. This action enhances FundersClub's offering, providing a new pathway for companies to access public capital through this popular fundraising method. Reg A+ permits private companies to raise funds from the general public, offering a cost-effective alternative to traditional funding options. This development is foreseen to support a wider spectrum of companies in their growth journeys.

Regulation A+

Regulation A+ is a aspect of securities legislation in the United States that permits companies to raise capital from the public through crowdfunding. It provides a streamlined process for smaller businesses to attract investment, offering them to raise up to $75 million in a 12-month period. Regulation A+ filings are made with the Securities and Exchange Commission (SEC), which reviews them to ensure compliance with federal securities laws. Once approved, companies can leverage Regulation A+ crowdfunding platforms to connect with investors and raise funds.

- Regulation A+ platforms offer a variety of services to both companies and investors. They manage the process of raising capital, providing tools for marketing campaigns, investor engagement, and financial disclosure.

- Investors who participate in Regulation A+ offerings have the opportunity to acquire a share of ownership in a company while also contributing to its growth.

Regulation A Plus IPO Overview

A Regulation A+ IPO, also known as Reg A+ IPO, offers a fresh opportunity for companies to raise capital through the public. This type of IPO permits companies to offer their securities to retail investors , providing broader reach to investment opportunities. A Reg A+ IPO summary provides crucial information about the offering, including the company's business model , financial history , and risks . Investors can use this data to evaluate the opportunity before committing to the IPO.

Regulation A+ Offerings

Regulation A+, also known as Provision 257 of the Securities Act of 1940, provides a mechanism for companies to raise capital from the public through the issuance of securities. This rule establishes specific requirements that issuers must comply with in order to conduct an A+ offering. It offers a more accessible route for capital formation compared to traditional initial public offerings (IPOs), making it an attractive alternative for smaller companies.

Key features of Regulation A+ include a structured system, allowing for different capital limits, and streamlined reporting burdens. Companies must still submit their offering documents with the Securities and Exchange Commission (SEC) and provide investors with comprehensive disclosures.

- Companies can raise capital from both accredited and non-accredited investors under Regulation A+.

- The SEC reviews offering documents to ensure they are compliant with relevant regulations.

- Investors receive certain protections, such as the right to sue for inaccuracy in the offering documents.

Guidelines A+ Crowdfunding

Securities Fundraising regulations for Regulation A+ crowdfunding can be complex and require careful navigation. Businesses seeking to raise capital through this method must adhere to strict Standards set forth by the Securities and Exchange Commission (SEC). These regulations cover various aspects, including the type of information that must be Revealed to investors, the maximum amount of funds that can be raised, and the Qualification for both the company and its investors.

- Comprehending these regulations is crucial for companies Intending to successfully complete a Regulation A+ offering.

- It is highly Recommended to consult with experienced legal and financial professionals who specialize in securities law and crowdfunding.

Regulating SlideShare content a Act of 1933 JOBS Act section 106 Regulation A+ Tier 2 Offering

The intersection of SlideShare, a popular platform for content sharing, and securities regulations presents unique challenges. New provisions under the JOBS Act , specifically section 106, have created opportunities for companies to utilize platforms like SlideShare for conducting Regulation A+ Tier 2 Offerings. However, navigating the legal intricacies surrounding securities while leveraging platforms including SlideShare requires careful consideration.

- Businesses contemplating a SlideShare-based Reg A Tier 2 offering must meet all requirements of the securities laws.

- Disclosure requirements are crucial for informing investors about the investment opportunity

- Consultation with securities lawyers is strongly advised to navigate the regulatory landscape effectively.

{Companies should alsoconsider the potential impact ofSlideShare's policies on their content. Understanding and adhering to SlideShare's content policies is {essential formaintaining a positive presencethrough the platform.The purpose, scope, and implementation of each regulation.

Regulation A+ DPO

A Regulation A DPO is a document that outlines the guidelines for handling data subject inquiries under regulation A. This vital component of a company's adherence helps ensure transparency when dealing with data subject requests as outlined in Regulation A+. Ultimately, the DPO promotes that companies are effectively adhering with the mandates of Regulation A++.

SEC Approves New “Reg A+” Rules for Capital Raising

In a landmark decision that promotes the funding landscape, the Securities and Exchange Commission (SEC) has finally approved new regulations under Regulation A+, commonly known as “Reg A+.” These enhanced rules are designed to boost capital raising for emerging companies through crowdfunding.

Under the new Reg A+ regime, companies will have more flexibility in the quantity of capital they can raise from the public, while also enjoying less complex disclosure requirements. This move is expected to energize entrepreneurs and small businesses by providing them with a efficient pathway to secure funding.

- Furthermore, the SEC's decision reflects a growing recognition of the potential of crowdfunding in fueling economic expansion.

- As a result, investors will now have a broader range of choices to invest in promising startups and contribute to their success.

The new Reg A+ rules are currently being implemented on [Date]. This development is poised to transform the fundraising landscape, creating a more vibrant ecosystem for capital formation.

Regulation A+

Regulation A+ and Regulation D are two distinct methods for raising capital through securities offerings in the United States. They offer different benefits and are tailored to companies of varying scales.

Regulation A+ is designed to facilitate access to public funding for smaller businesses by allowing them to raise up to $50 million in a single offering through general solicitation and advertising. In contrast, Regulation D primarily serves as a framework for private placements of securities, enabling companies to raise capital from a limited number of accredited investors without the same level of public disclosure necessities.

Rule 506 of Regulation D offers two primary exemptions: Rule 506(b) and Rule 506(c). Under Rule 506(b), companies can raise capital from an unlimited number of accredited investors, but are restricted to a maximum of 35 non-accredited investors. Rule 506(c) permits general solicitation and advertising, providing greater flexibility for companies in reaching potential investors. However, it necessitates that all purchasers be accredited investors.

Rule 506(d) is a section within Regulation D that specifically addresses the offering of securities to "qualified purchasers." This exemption allows companies to raise capital from sophisticated institutional investors who meet certain wealth criteria, providing an avenue for larger private placements.

Ultimately, the choice between Regulation A+ and Regulation D depends on a company's specific needs and circumstances. Factors to consider include the desired amount of funding, the target investor base, and the level of public disclosure required.

Regulation D - Rule 506(b) vs Offerings 506(c) Series 7

Navigating the intricacies of Regulation D and its two primary exemptions, Rule 506(b) and Rule 506(c), can be a complex task for those in the securities industry. This cheat sheet provides a concise guide to help you distinguish these crucial rules and understand their implications for fundraising activities.

Rule 506(b) allows companies to raise capital from an unlimited number of accredited investors, alongside a maximum of thirty-five non-accredited participants. This exemption demands verification of investor status and relies on private placement memos to provide essential information about the offering.

Conversely, Rule 506(c) enables companies to raise funds from an unlimited number of accredited investors without any boundaries on non-accredited participants. However, it mandatespromotional efforts, along with strict due diligence requirements and a thorough verification process for all investors.

- Rule 506(b) - Limited non-accredited investors

- Rule 506(c) - Unlimited accredited investors

Understanding the nuances of each rule is vital for companies seeking to raise capital through private placements. Consulting with a qualified securities attorney can provide valuable guidance and ensure compliance with applicable regulations.

Unveiling DreamFunded Resources on Regulation A+

Regulation A+, a investment mechanism within the U.S. securities laws, provides a unique avenue for companies to raise capital from the wider investor base. DreamFunded, a prominent platform specializing in Regulation A+ funding, offers a comprehensive set of materials to guide both companies seeking funding and capitalists looking for emerging investment possibilities.

- Among these resources are in-depth explanations on the mechanics of Regulation A+, seminars with industry specialists, and a vetted directory of companies currently leveraging this funding mechanism. DreamFunded's dedication to transparency and education empowers both sides of the investment spectrum, cultivating a robust ecosystem for Regulation A+ investments.

The OTC Markets Tripoint FINRA Jumpstart Our Business Startups Jobs act Tycon

The latest developments in the investment sphere are generating possibilities for growing enterprises. One significant example is the intersection of public exchanges with the JOBS Act framework. This dynamic ecosystem can offer a special opportunity for firms to accessfunding and expand.

Tycon, a leading force in the sector, is enthusiastically engaged in this evolution. Their mission is to facilitate the disconnect between companies and funding sources. Via their network, Tycon is supporting growth-stage to access the complexities of raising capital.

Obtaining SEC Approval: A Crucial Step for Crowdfunding Platforms

Navigating the complex world of finance requires meticulous planning and adherence to regulations. When it comes to crowdfunding platforms like GoFundMe, Kickstarter, and Indiegogo, securing/acquiring/gaining SEC approval is a paramount goal. This process ensures/guarantees/verifies that {these platforms/their ventures adhere to federal securities/investment/financial laws.

For equity investment ventures, complying with/meeting the requirements of/submitting to SEC qualification is essential/crucial/vital. This involves a rigorous review that assesses/evaluates/analyzes the fundraising activities/investment proposals/business models to protect investors and maintain market integrity/ensure transparency and fairness/foster a secure financial environment.

Understanding/Grasping/Comprehending the SEC's role in regulating/overseeing/governing crowdfunding platforms and equity investments is indispensable/vital/crucial for both entrepreneurs and potential investors. By understanding these regulations/familiarizing themselves with these guidelines/keeping abreast of these requirements, stakeholders can navigate the financial landscape successfully/make informed decisions/participate confidently in the capital markets.

{

EquityNet Funding Merrill Lynch Sec Reg A

The landscape of funding is rapidly evolving, with innovative platforms like CrowdFund connecting investors with promising companies. Crowdfunding, a form of equity crowdfunding, allows individuals to invest in diverse sectors such as biotech companies through online platforms. Regulation D and the JOBS Act have paved the way for greater availability to early-stage investments, empowering both unaccredited investors and seasoned private equity firms to participate in shaping the future of industry.

SoMoLend and other fintech platforms are disrupting traditional banking, offering streamlined solutions for funding. Bloomberg continue to provide insights into the evolving world of investing, highlighting the potential returns and risks associated with seed stage investments.

- MicroVentures provide unique opportunities for individuals to invest in real estate, energy, or tech projects.

- Early-stage capital raise often involve high risk but also the potential for significant rewards.

- Offering equity are becoming increasingly sophisticated, leveraging technology and data analytics to connect investors with promising ventures.

Alicia Silverstone Then & Now!

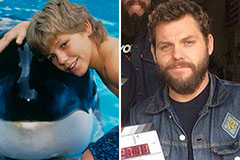

Alicia Silverstone Then & Now! Jason J. Richter Then & Now!

Jason J. Richter Then & Now! Lark Voorhies Then & Now!

Lark Voorhies Then & Now! Amanda Bearse Then & Now!

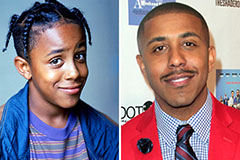

Amanda Bearse Then & Now! Marques Houston Then & Now!

Marques Houston Then & Now!